Hi guys, I am sharing about a trading platform that I have been using (to buy US stocks) since August 2018.

As you all might already know, I am just an amateur investor and has been dabbling into various kinds of investing just to see which style actually suits my personality.

So of course, investing in stocks means you need a broker/brokerage account to execute the orders on your behalf, and honestly, there are a shit ton of local/overseas brokerages by various banks, offering different levels and forms of fees structure.

Hence, I did my mini-research and came to the conclusion that SaxoTraderGO was materially the most cost-effective brokerage platform, with the caveat of only using it to buy US stocks. However, fees are almost always being constantly revised and there may or may not be better deals out there currently. So, please do your own due diligence. (As for Singapore stocks, I use DBS Vickers.)

In addition, FinancialHorse and I managed to split a $500 commission/referral fee with each other during a promotional period, so that was really the icing on the cake. 🙂

Anyhow, the application process took quite awhile and it required me to physically verify my identity and I had to pass a SGX test.

After I got my account, everything else came quite naturally.

Firstly, the mobile phone application’s user interface is very user-friendly and I particularly like how the profits/losses calculated are net-net (something which I only come to appreciate after messing around with Funding Societies and their seemingly too-good-to-be-true/overly-euphemistic statistics). *Update on or before 30 Dec 2019: Funding Societies has updated their statistics projections.

However, I must say that Saxo also has its own fair share of ‘hidden’ fees, disguising as inactivity fee. So, do plan your investment timing consistently when using Saxo to buy/sell stocks..

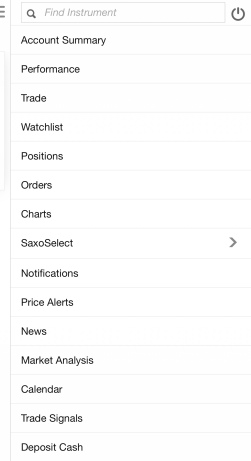

Picture time!

So, it has just about as many features as any other regular brokerage platforms which I honestly did not utilise much. However, I quite like the performance feature as it does not clutter too much information, yet showing what you really just need to know (as shown below).

Over here, I chose the US 500 benchmark as that is technically what most people-who-knows-shit-about-investing use, some use Dow Jones Industrial Average here and there, but just use pretty much whatever floats your boat.

As you can also see, my return is consistently above US 500’s return. If you want to replicate that, just overweight on tech stocks. The caveat is that when times are bad, it will then be below just about any benchmarks consistently. Note that the aforementioned is just my opinion and not to be constituted as investment advice to be relied upon (i.e disclaiming any and all potential liabilities).

Next, we have the account summary.

The account summary is also a very good feature because it shows that my margin utilisation is 0%, a.k.a I’m not a trader. Very good. Moving on.

Account is in USD, which is very important since this account is only for purchasing US stocks. This is something I learnt from Financial horse, if not every transaction will incur currency conversion charges and you can kiss your profits goodbye, if any.

Actually, I am almost done with my review.

Basically, my point is that I have been using SaxoTraderGO for quite awhile and it did not pose me much software/technical issues, customer service is acceptable and you hitherto get cheaper US stocks in the long run.

Hence, I recommend trying out this if you are a noob amateur like me and costs are something which you consciously want to lower.

If you have read until this far, thanks! Let me know what you think and I will also be happy to answer questions. 🙂